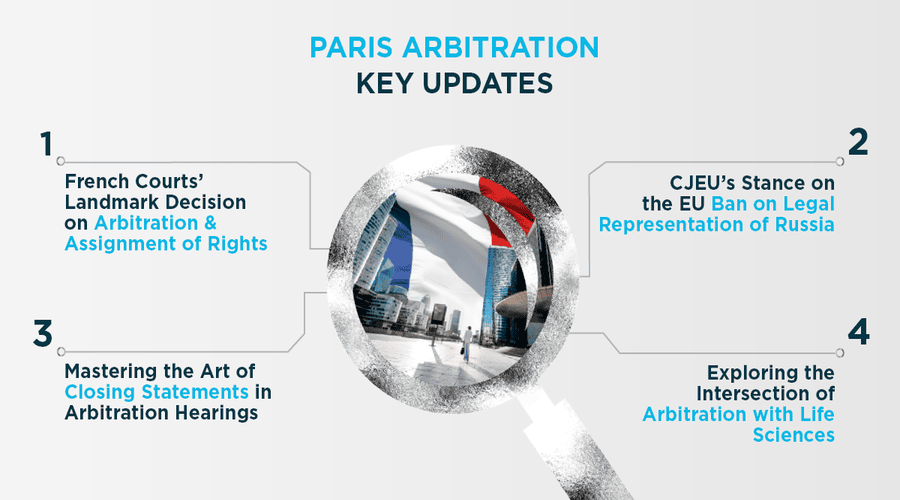

Welcome to the Addleshaw Goddard's November 2024 International Arbitration Group Newsletter

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Morbi ac dictum massa. Aliquam varius risus dui, euismod molestie velit vehicula commodo. Curabitur ullamcorper dolor ipsum, quis congue lorem faucibus ut. Praesent suscipit, felis sed lobortis rhoncus, sapien mi hendrerit augue, eget pretium lectus diam quis nisl. Donec vulputate est et ullamcorper auctor. In porta urna in dolor fermentum, et convallis diam laoreet. Pellentesque non nunc non quam volutpat pharetra. Aliquam ac interdum urna.

If you would like to get in touch you can email us here.

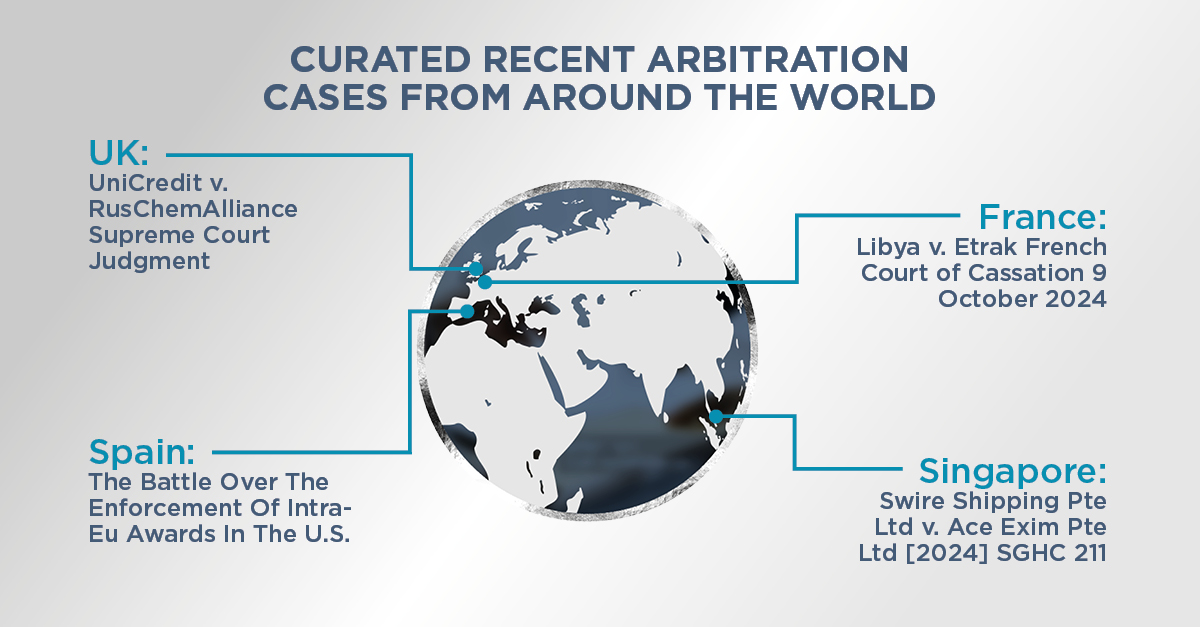

INTERESTING CASE LAW FROM AROUND THE WORLD

In this section, we share a selection of pivotal recent legal decisions from locations where our Group acts frequently for clients - Asia, the Middle East, France, UK, Germany and Spain – highlighting both the dynamic interplay of law and arbitration in these key jurisdictions, and offering our takeaway commentary. Please expand any of the regions below to reveal the curated cases.

United Kingdom

UniCredit v RusChemAlliance Supreme Court Judgment

English Supreme Court Confirms Reach of English Court in Granting Injunctive Relief

The UK Supreme Court recently released its reasoned judgment in UniCredit Bank GmbH v RusChemAlliance LLC. The much-awaited judgment confirms the English courts' willingness to assert its jurisdiction to prevent a party from breaching an arbitration agreement, even where the seat of the arbitration is not in England.

The decision relates to proceedings commenced by RusChem before the Russian courts in respect of English law governed contracts that contained French-seated arbitration agreements. UniCredit applied for an anti-suit injunction to the English court, which was rejected at first instance but upheld by the Court of Appeal.

The issue before the Supreme Court was whether the English court had jurisdiction over UniCredit's claim. This required the Court to consider (i) whether the contractual arbitration agreements in the relevant bonds were governed by English law (the Governing Law Issue), and (ii) whether England was the proper place to bring the claim (the Proper Place Issue).

Governing Law Issue

The Supreme Court considered whether UniCredit could establish that the arbitration agreements (as separable contracts) were governed by English law. Applying the leading judgments in Enka v Chubb and Kabab-Ji, the Court held that the position was clear: the arbitration agreements were governed by English law, because the choice of English law for the underlying contracts would also apply to the arbitration agreements.

RusChem argued that it should be inferred that the arbitration agreements were, in fact, governed by French law. This was because the law of the seat of arbitration – in this case, French law – would treat the arbitration agreements as governed by the law of the seat, . The Supreme Court disagreed, finding that it was artificial to attribute such intention to the parties and that it would be unduly complicated to apply the approach advocated by RusChem.

The Court's approach underscores the English court’s preference for a general rule, in deciding the governing law of an arbitration agreement (where not express), based on the objective choice of the parties. This approach stands in stark contrast to the position taken under French law, which predominantly applies its national law to arbitration agreements. It also stands in contrast to the approach taken in the Arbitration Bill (currently passing through Parliament), which contains an amendment providing that an arbitration agreement will be governed by the law of the seat (absent express agreement otherwise).

Proper Place Issue

RusChem argued that the French court was the proper forum. The Supreme Court disagreed. It said that it is not right that there is only one court that can properly exercise jurisdiction over a party for the purpose of enforcing the negative promise contained in an arbitration agreement not to bring court proceedings.

The Court held that in circumstances where an injunction is being sought to restrain foreign proceedings commenced in breach of an agreement to refer the matter to arbitration, there is a presumption that the English court is the proper place to bring such proceedings. That is unless a strong reason can be shown otherwise based on the fact that because the seat of arbitration is abroad, it is inappropriate for the English court to exercise jurisdiction.

The Court took the view that England & Wales was the proper place to grant anti-suit relief, as all it was doing was preventing a party (RusChem) from breaking its contract to arbitrate. The French courts did not have the power to make such an order and, even if they did, this did not make it inappropriate for the English court to grant an injunction. The Court did not consider that it was interfering with the supervisory jurisdiction of the French courts (as the seat of any arbitration, if commenced).

We cannot necessarily expect an English court ordered anti-suit injunction to necessarily have any real impact in a Russian court, but it should have an impact in England and in most other countries.

Key takeaways

(1) The English court will try to assist a party that is being dragged into foreign court proceedings contrary to an agreed arbitration agreement to the extent that the arbitration agreement provides for a seat in England or is governed by English law; and (2) Parties should clearly and expressly specify in their contracts the law governing the arbitration agreement, particularly where the underlying contract includes a governing law which is different to that of the chosen seat in the arbitration agreement.

Singapore

Swire Shipping Pte Ltd v Ace Exim Pte Ltd [2024] SGHC 211

High Threshold to Set Aside an Arbitral Award

Background

In Swire Shipping Pte Ltd v Ace Exim Pte Ltd [2024] SGHC 211, the Singapore High Court dismissed Swire Shipping's ("Swire") application to set aside an arbitral award, emphasising the principles of minimal curial intervention in arbitration.

The case concerns a dispute arising from a contract for the sale of a vessel for scrap, where the vessel's delivery location became inaccessible due to COVID-19 restrictions. As Ace Exim did not designate an alternative place of delivery, Swire delivered the vessel at a place customary for vessels to wait. Swire claimed that it had validly tendered the notice of readiness ("NOR") and was entitled to payment of the balance of the purchase price. The Arbitrator found that Swire was not entitled to validly tender the NOR as the vessel was not at the customary waiting place provided under the contract. Therefore, Ace Exim was not liable to pay Swire the balance of the purchase price.

Setting Aside Application

Swire challenged the final award, arguing that it was tainted by jurisdictional and procedural defects. Swire specifically challenged the Arbitrator's findings on (i) the customary waiting place for vessels; and (ii) the interpretation of evidence given by Swire's expert witness. On both points, Swire contended that that there had been a breach of natural justice as it had been deprived of a reasonable opportunity to present its case. Swire also argued that in the alternative, the first finding was made in excess of the Arbitrator's jurisdiction.

High Court's Decision

The court found that the Arbitrator's findings were within the scope of the parties' submission to the Arbitrator's jurisdiction and not made in breach of natural justice.

First, the court considered whether there is a further requirement to demonstrate prejudice if an arbitral tribunal is found to have exceeded its jurisdiction. With reference to precedent, the position in Singapore is that "where the charge was that the tribunal had exceeded its jurisdiction by addressing matters beyond the scope of submission, there was no further requirement for the applicant to show that it had suffered real or actual prejudice." The court also confirmed that a decision on an issue that was raised by the parties (but which may not have been specifically pleaded), is not made in excess of the arbitral tribunal's jurisdiction. While the court declined to lay down a specific test, it found the Arbitrator's finding within its jurisdiction as it had a "genesis" in, bore a "close nexus" to, or was "intertwined with" the issues as framed by the parties before the Arbitrator.

Next, the court dealt with Swire's allegation that the award was made in breach of natural justice. The court was satisfied that the Arbitrator adopted a chain of reasoning that flowed reasonably from the arguments advanced by the parties. As the Arbitrator's finding was "reasonably connected" to their arguments and objectively foreseeable, it was unrealistic for Swire to claim it had not been afforded reasonable opportunity to address the issues. Where an applicant pleads a breach of natural justice, there must also be demonstrable prejudice. However, Swire had not shown how its rights had been prejudiced. Ultimately, Swire's application was dismissed as having no merit.

While the court criticised the readability of the arbitral award, it noted that the quality of the award's reasoning, while unsatisfactory, did not constitute a valid ground for setting it aside. It found no unfairness in the award as this was a risk that Swire "took with open eyes" and "necessarily accepted with open arms". The court also cautioned against "due process paranoia" where arbitral tribunals act defensively in their procedural decisions out of concern that otherwise it might lead to later challenges against an award for violating a party’s due process rights.

Finally, the court affirmed the principles that guide the court's interaction with arbitral tribunals, notably minimal curial intervention and the importance of respecting the parties' autonomy and choice of arbitration as a dispute resolution mechanism. In doing so, the court observed that "parties to an arbitration do not have a right to a “correct” decision from an arbitral tribunal, but merely one within the scope of their agreement to arbitrate, and that is arrived at following a fair process". Thus, dissatisfaction with an arbitrator's findings or reasoning does not itself suffice to invalidate an award.

Key Takeaways

This case highlights the Singapore judiciary's hesitance to scrutinise the substantive merits of arbitral decisions, underlining the necessity for arbitral awards to be clearly and coherently reasoned to ensure their understanding and enforceability. The court observed that "minimal curial intervention has to cut both ways; there is no cakeism when parties (particularly commercial ones) have made a considered and informed choice in their contracts to limit the role of the courts when it comes to resolving their disputes." Accordingly, parties who have subscribed to arbitration as a dispute resolution mechanism need to accept that any right of recourse to the courts is limited.

Spain

The Battle Over The Enforcement Of Intra-Eu Awards In The U.S.

The Spanish reform of renewable energy incentives

In 2007, Spain introduced incentives for its renewable energy sector, attracting a significant number of foreign investors to the country. However, from 2012 onwards, the Spanish government reversed these incentives and imposed a 7% tax on electricity production. Many investors opposed Spain's last decision and sought arbitration under the Energy Charter Treaty (“ECT”) before the International Centre for Settlement of Investment Disputes (“ICSID”).

Key jurisdictional dispute: U.S. Courts and Intra-EU award enforcement

A hot spot in these arbitration disputes is whether U.S. Courts have jurisdiction to recognise and enforce intra-community investment arbitration awards. The last chapter in this complex legal battle occurred on August 16 2024, when, after three conflicting lower Court decisions, the District of Columbia Circuit (“D.C.”) Court of Appeals issued a landmark ruling on the enforcement of ECT awards against Spain.

Spain relied on the judgements of the European Court of Justice in Slovak Republic v. Achmea BV and Republic of Moldova v. Komstroy to hold that there was no valid arbitration agreement with the investors. These rulings found that the arbitration clauses in an intra-EU bilateral investment treaty (as the ECT) were incompatible with EU law for intra-EU disputes. Based on these decisions, Spain claimed sovereign immunity under the U.S. Foreign Sovereign Immunities Act (“FSIA”) and argued that U.S. Courts lacked jurisdiction to enforce the awards.

The D.C. Court determined that, under the FSIA, a foreign state is immune from U.S. Court jurisdiction unless the arbitration exception applies, and, in that case, the D.C. Court found that the three “jurisdictional facts” required for the arbitration exception to apply were met: (i) the ECT constitutes an agreement to arbitrate; (ii) ICSID has issued an arbitration award; and (iii) both the ICSID Convention and the ECT govern the enforcement of the award.

As a result, the D.C. Court concluded that the intra-EU nature of an award does not prevent U.S. Courts from exercising jurisdiction under the FSIA. However, it clarified that this ruling does not compel U.S. Courts to enforce such awards, leaving unresolved the “merits question” of whether the ECT's arbitration provision extends to EU nationals and therefore, Spain ultimately entered into legally valid agreements with the companies or whether, on the contrary, because Spain lacked legal capacity under EU law to make an offer to arbitrate to the EU investors, there was no valid arbitration agreement and the arbitration exception under the FSIA could not apply.

Although the D.C. Court´s decision did not provide for the enforcement of the award, it paved the way for the successful enforcement of intra-community awards in the U.S.

A new U.S. Court ruling

Just weeks later, on 26 September 2024, the D.C. Court granted a petition by JGC Holdings Corporation (“JCG”), a Japanese investor, to enforce an ECT award against Spain. JGC had initiated ICSID arbitration over Spanish cuts to renewable energy incentives, which resulted in the tribunal awarding EUR 23.51 million. After Spain's unsuccessful attempt to annul the award, the D.C. Court ruled in favour of JGC, authorising enforcement of the ECT award under the ICSID Convention.

The U.S. Court stated that the award was entitled to full faith and credit and found that the doctrines of Act of State, Forum Non Conveniens and Comity and Foreign Sovereign alleged by Spain were not applicable. Moreover, in granting the petition to enforce the award, the Court highlighted that, since the Congress explicitly exempted ICSID awards from de Federal Arbitration Act (which empowers district Courts to review awards), when ICSID awards are involved, the Court should do no more than examine the authenticity and enforce the awards.

This ruling marked the first time a U.S. Court enforced an ECT award against Spain, granting JGC the right to initiate recovery proceedings by seizing Spanish business assets in the U.S.

Impact on future Intra-EU award enforcement

The August 16 ruling marked a positive development for other award-holders, with the D.C. Court stating that the ECT offers “powerful reasons” to conclude that its arbitration clause extends to EU nationals.

However, the September 26 ruling is even more significant for foreign investors. While it did not directly address whether the ECT arbitration provision extends to EU nationals (as JGC is a Japanese company), it strengthens the position of non-EU investors seeking to enforce ICSID-ECT awards against Spain in the U.S.

With over a dozen similar cases pending before the D.C. Court and numerous actions in other jurisdictions, this legal battle is far from over.

In Spain, both rulings should reinforce confidence in arbitration as a system for resolving international disputes, as they confirm the enforceability of awards against a sovereign state based on a bilateral treaty ratified by that state, despite its strong opposition (as it was the case with the Spanish State in disputes under ECT).

France

Libya v. Etrak French Court of Cassation 9 October 2024

Temporal Boundaries of BITs: Insight from the French Court of Cassation

In a decision dated 9 October 2024, the French Court of Cassation addressed a key question in the realm of investment treaty arbitration: Can an arbitral tribunal declare itself competent for disputes arising from investments made before the entry into force of a Bilateral Investment Treaty (BIT)? This case, involving the State of Libya and the Turkish company Etrak, offers valuable insights into the interpretation of BITs and the jurisdiction of arbitral tribunals in the context of investment disputes.

Background

The dispute originated from public works contracts signed in the 1980s between Etrak and the State of Libya. Following Libya’s failure to honour a 2013 settlement agreement related to these contracts, Etrak sought compensation under the 2009 Libya-Turkey BIT. An ICC arbitral tribunal ruled in favour of Etrak in 2019, finding Libya in breach of its obligation to ensure fair and equitable treatment to Etrak’s investment.

The Paris Court of Appeal confirmed the exequatur of the award in France, prompting Libya to challenge the decision before the French Court of Cassation. Before the Court, Libya contended that the arbitral tribunal lacked jurisdiction ratione temporis, arguing that the dispute pre-dated the BIT's entry into force and that the initial 1980s works did not fall under the BIT’s protection.

The Court of Cassation’s Analysis

The decision of the French Court of Cassation hinged on the interpretation of the Libya-Turkey BIT and the nature of the dispute. In assessing the tribunal’s jurisdiction under the BIT, the Court started by recalling that, in the field of transnational investment protection, a state’s consent to arbitration arises from a treaty’s standing arbitration offer, “directed to a category of investors that the treaty defines for the resolution of disputes concerning the investments it specifies”.

The Court then proceeded to analysing the appeal decision and focused on whether the dispute, rooted on the non-execution of the 2013 settlement agreement, fell within the scope of the BIT. It first highlighted that under the BIT, “only disputes directly linked to investment activities qualified for protection”, while noting that Etrak’s financial claims resulting from the settlement agreement were not considered ‘investments’ under the BIT as such, but only as they related to the actual investments from the 1980s construction works.

The Court concluded that since the dispute regarding the settlement agreement’s non-execution was separate from the initial dispute over payment for construction works, it did not meet the BIT’s investment definition as it wasn’t a direct result of the investment. Consequently, the Court overturned the appeal decision and remanded the case back to the Paris Court of Appeal.

Conclusion & Takeaway

This decision highlights the meticulous approach adopted by French courts to assess the jurisdiction of arbitral tribunals in the context of investment disputes. It emphasizes the importance of treaty interpretation in verifying that disputes not only arise after the relevant treaty’s entry into force but also are directly connected to activities defined as investments under the BIT. It thus (i) underscores the critical role of treaty interpretation in determining the jurisdiction of the arbitral tribunal, particularly in cases involving pre-treaty investments and, as a result, (ii) serves as a crucial reminder for investors and states alike of the need for clear understanding and precise drafting of investment treaties to ensure their intended protective measures are enforceable.

PERSPECTIVES

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nunc dui eros, blandit id faucibus in, sodales quis enim. Donec quis ante eu nisi accumsan porta non sed ex. Donec elit dolor, vestibulum ac sollicitudin eget, tempor in risus. Cras finibus leo mi, quis aliquam purus condimentum et. Curabitur porttitor, sapien non sodales luctus, leo elit congue tortor, a tempus lacus mi a nisl. Aliquam a nibh a arcu tristique convallis. Pellentesque finibus elit neque, ac rhoncus quam tempus vel. Nulla ultrices, augue a suscipit facilisis, lacus nisl dictum sem, vitae dignissim arcu leo at nisi. Integer aliquet pretium ex quis sollicitudin.

France

United Arab Emirates

Recovering Costs Under ICC Rules Arbitration In The UAE: A Welcome Return To Certainty

In our last newsletter we reported on a recent decision by the Dubai Court of Cassation in Sobha Engineering and Contracting LLC v. Emerald Palace Interior Decoration LLC (Case No. 821/2023), which prevented a successful party from enforcing part of an ICC Rules award that included an award of legal fees.

In this edition, we report on the Court's reversal of that decision in Case No. 756/2024, which has brought welcome clarity as to what the parties to an arbitration must do to enforce an award of legal fees in the UAE.

It has long been the practice of the UAE courts to enforce the bargain struck between parties under the maxim that 'agreements must be kept' (pacta sunt servanda). The application of that principle extended to arbitration agreements in contracts made between the parties and any award rendered in accordance with those agreements would (subject to certain conditions) be enforced by the UAE courts. The UAE courts would equally enforce any award of certain, but not all, the costs incurred by the successful party.

However, successful parties have often struggled to recover money spent on legal fees because of the absence of express provisions within national legislation and the applicable arbitration rules. In 2012, the Dubai Court of Cassation explained that the arbitral tribunal must have been specifically empowered to make such an award of costs either by: (1) applicable legislation; (2) the arbitration agreement; or (3) arbitral rules agreed by the parties (including those incorporated by reference in the arbitration agreement) (Case No. 282/2012).

The successful party faced difficulties for two reasons. First, at the time that case was decided UAE legislation did not grant arbitral tribunals the power to make an award of legal fees. Second, the commonly used 2007 version of the Dubai International Arbitration Centre (DIAC) rules of arbitration limited the recovery of costs to DIAC's own administrative fees and the fees and expenses of the tribunal. Only if the parties had agreed within the arbitration agreement itself, or within the terms of reference, would the tribunal have the power to make an award that included legal fees. The successful party was better served where arbitrations were heard under the ICC rules of arbitration, which expressly provide for the tribunal to make an award of "reasonable legal and other costs incurred by the parties for the arbitration" (article 38(1) in the 2021 and versions). It had been understood by practitioners in the region that this wording was sufficient to grant the arbitral tribunal the power to make an award of costs that included legal fees.

A certain degree of hope was pinned on the introduction of Law No. 6 of 2018 (the Arbitration Law) but it went only as far as to codify what the Court of Cassation had previously decided. In addition to providing for an award of the tribunal's fees and expenses, and of tribunal appointed experts, Article 46 provides that the parties are free to agree the categories of costs that a successful party may recover from the unsuccessful party, which of course may include the legal representative's fees.

Improvement came in March 2022, when the new DIAC Rules replaced the 2007 version. The 2022 rules expressly grant the arbitral tribunal the power to make an award which included, "the fees of the legal representatives and any expenses incurred by those representatives, together with any other party’s costs as assessed and determined by the Tribunal." (Article 36.1).

That new definition was tested in the Dubai court of appeal in 2024 (Case No. 33/2023), which confirmed (quite sensibly) that where the parties had agreed to apply the DIAC 2022 rules, the arbitral tribunal was entitled to make an award that included payment of the successful party's legal fees. The decision in 33/2023 is therefore consistent with the approach outlined in 282/2012 and Article 46 of the Arbitration Law, both of which provide that arbitration agreements made by the parties will be enforced (subject to compliance with certain conditions) and that incorporation of the tribunal's power by reference to arbitral rules are permitted.

However, and within only a few weeks of the Dubai Court of Appeal decision referenced above, the Dubai Court of Cassation found that article 38(1) of the ICC rules did not expressly grant the power to the tribunal to make an award of costs that included the successful party's lawyer's fees (Case No. 821/2023). The decision upheld the judgment of the Dubai Court of Appeal that had been issued in the previous year (Case No. 2/2023). Given the clear wording of Article 38(1) of the ICC rules it was difficult to reconcile the approach of both the Appeal Court and the Cassation Court on the issue of an award of legal fees made in an ICC rules arbitration. The UAE court's strict interpretation of the wording of Article 38(1), which references "legal costs" but does not expressly mention 'lawyer's' or 'attorney's' fees, suggested a certain hostility to international arbitration that had caused concern amongst practitioners in the region.

Case No. 756/2024 of 19 November 2024

However this month (November 2024), the Dubai Court of Cassation has reversed the position again. In Decision No. 754/2024 issued on 19 November 2024, the Court of Cassation emphasised the need to interpret Article 38(1) of the ICC Rules as it is clearly written. Specifically, the Court found that the use of the word "includes", and with reference to "other reasonable costs incurred by the parties for the arbitration" clearly represents the author's intention that a tribunal was not limited to awarding to a successful party the costs of the tribunal, the ICC's fees and expenses and the fees of expert's appointed by the tribunal. The word "includes" denotes a non-exhaustive list of recoverable costs and that the recovery of the successful party's lawyer's fees was captured by the definition of "other reasonable costs", in line with and common in international arbitration practice.

Crucially, this decision provides welcome clarity that even where the arbitration agreement does not expressly provide the arbitral tribunal with the power to make an award of legal fees the parties to arbitration can rely on an incorporation by reference of the power provided by Article 38(1) of the ICC Rules.

Germany

The recent Reform in German arbitration law

On 26 June 2024, the German Federal Government has adopted a bill on the modernisation of the German arbitration law (Entwurf eines Gesetzes zur Modernisierung des Schiedsverfahrensrechts) (the “Bill”) which includes a number of notable refinements of the German arbitration law. While the bill will need to be resubmitted due to the upcoming elections in Germany, it offers an insight into the future of Germany arbitration law. At the same time it is still subject to discussion and potential changes.

If it is adopted, it will provide for transitional provisions for arbitration agreements already concluded when the new law comes into force and ongoing arbitration and civil court proceedings.

The goal of the Bill is to make selective changes to German arbitration law more than 25 years after its fundamental revision in 1997 to adapt it to the needs of the present, to increase its efficiency and to strengthen Germany’s attractiveness as a significant national and international arbitration location.

To achieve this goal, the German Federal Government proposed four main amendments: (1) Freedom of form for arbitration agreements in commercial transactions, (2) strengthening transparency in arbitration and promoting the development of law, (3) strengthening the digitalisation of procedural law and (4) promoting the English language in proceedings before civil courts.

1. Freedom of form for arbitration agreements in commercial transaction

Considering Option II of Article 7 of the UNCITRAL Model Law, which allows arbitration agreements to be concluded without any formal requirements, the Bill provides that only arbitration agreements involving a consumer (Verbraucher), must be signed by both parties (whereby the written form can be replaced by the electronic form) (Section 1031(1) of the Draft Code of Civil Procedure – “ZPO-E”). Arbitration agreements to which no consumer is a party shall therefore be possible without any formal requirements.

2. Strengthening transparency in arbitration and promoting the development of law

- Publication of arbitral awards: To strengthen transparency in arbitration and promote the development of the law, the Bill expressly authorises arbitral tribunals to publish their arbitral awards and any special votes in an anonymised or pseudonymised form, if the parties consent to the publication of the arbitral decision (§ 1054b ZPO-E). This takes into account that arbitral decisions often contain statements on important legal issues and are therefore also of public interest. However, in view of the generally low interest of arbitral parties to publish the awards, it is at least doubtful whether the proposal has any practical effect.

- Expressly allowing dissenting opinions: Due to conflicting jurisprudence on this issue in Germany, the Bill provides for arbitrators to be able to set out their dissenting opinion on an arbitral award or its reasoning in a special vote, unless the parties agree otherwise (Section 1054a ZPO-E). The proposed provision would settle the discussion and provide for legal certainty.

3. Strengthening the digitalisation of procedural law

- Video hearings: Considering the positive experiences with oral hearings before arbitration tribunals via video and audio transmission in recent years, the Bill provides for the possibility to conduct oral hearings via video at the discretion of the arbitral tribunal and unless the parties have agreed otherwise (Section 1047(2) ZPO-E).

- Electronical arbitral awards: The Bill also provides for the possibility to issue arbitral awards electronically at the discretion of the arbitral tribunal and if neither party objects (Section 1054 ZPO-E).

4. Promoting the English language in proceedings before civil courts

- Submission of English documents: According to the Bill, “the arbitration agreement” and “every document” in English relating to arbitration proceedings may also be submitted by the parties in English in arbitration-related proceedings before civil courts (Section 1063b(1) ZPO-E). As a result, there is no need for the parties to provide a translation for the respective document, which not only saves the parties the costs incurred, but also the time required for a translation. The term “document” has been chosen to cover all types of deeds, electronic documents, and other documents and thus to ensure the widest possible applicability.

- English as court language: Recently, the Federal States were provided with the possibility to introduce so called “Commercial Courts” for the handling of certain commercial disputes and introduce English as the court language in such proceedings (Justizstandort-Stärkungsgesetz, Federal Law Gazette 2024 I Nr. 302). The Bill now provides the Federal States with the possibility to refer certain proceedings in connection with arbitration that currently fall under the jurisdiction of the Higher Regional Courts to these Commercial Courts and order English to also be the court language in these proceedings, if the parties have so agreed (Section 1062(5), 1063(a) ZPO-E). This possibility is also created for any subsequent appeal proceedings before the Federal Court of Justice (Section 1065 ZPO-E).

5. Other notable amendments

- Restitutio In Integrum: While the reopening of proceedings before civil courts is clearly regulated, for arbitral proceedings, written law does not currently provide for the possibility of a judicial annulment of an arbitral award after a period of three months – even in the case of the most serious defects. For this reason, the Bill provides for an extraordinary legal remedy, the so-called application for restitutio in integrum, which makes it possible to have an arbitral award set aside by a civil court even after the three-month period has expired (Section 1059a ZPO-E).

- Joint appointment of arbitrators: For arbitration proceedings with joined parties on one side (Streitgenossen), an express provision has been included for the joint appointment of arbitrators, according to which the joined parties must jointly appoint the arbitrator, unless the parties have agreed otherwise (Section 1035(4) ZPO-E). If the joint appointment of an arbitrator is not made within one month after all joined parties have received a corresponding request from the other party, the arbitrator shall be appointed by the court at the request of the party or one of the joined parties.

- Correction of negative jurisdiction decisions: There is currently no possibility of judicial correction of an arbitral tribunal's decision rejecting its jurisdiction. Conversely, i.e. if an arbitral tribunal affirms its jurisdiction, such a correction is possible. The Bill now introduces the possibility of also correcting negative jurisdiction decisions by an arbitral tribunal. If an arbitral tribunal rejects its jurisdiction such arbitral award can be annulled be a civil court, if it is reasonably asserted that the arbitral tribunal wrongly rejected its jurisdiction (Section 1040(4), 1059 ZPO-E).

What provoked your passion for arbitration?

I guess a good answer would be that my passion for arbitration comes from its dynamism and its capacity to resolve disputes efficiently and effectively (or more efficiently and effectively than ordinary courts in Spain, at least). Also, not being subject to strict rules but begin able to design the process together with the other party introduces a level of control not typically found in court litigation.

What was the most fascinating case you have worked on?

The case is in fact still pending a final award. It's a case involving the application of rebus sic stantibus arising from the Ukrainian War in the context of a cryptocurrency sponsorship contract worth around €300 million. The number of jurisdictions involved, and the complexity of the facts make it a unique and highly interesting case.

What are the main arbitration topics in your jurisdiction?

This is a tough one since there's a variety of topics. However, I would highlight international commercial arbitration, IP and Tech sector disputes and, most of all, energy sector disputes (notably in the renewable energy sector, where the Madrid office has vast experience). Also, in recent months we have detected an increase in the number of enforcements of foreign awards.

How do you decompress after a stressful day?

It's not easy to de-stress from work when you have a 6-year-old little man and an 8-month-old baby waiting for you at home. That's why I do sport in the mornings – I go to the gym or run between 5 and 8k every morning. However, there's nothing I love more than playing football with my eldest son and bathing my little one in the evenings.