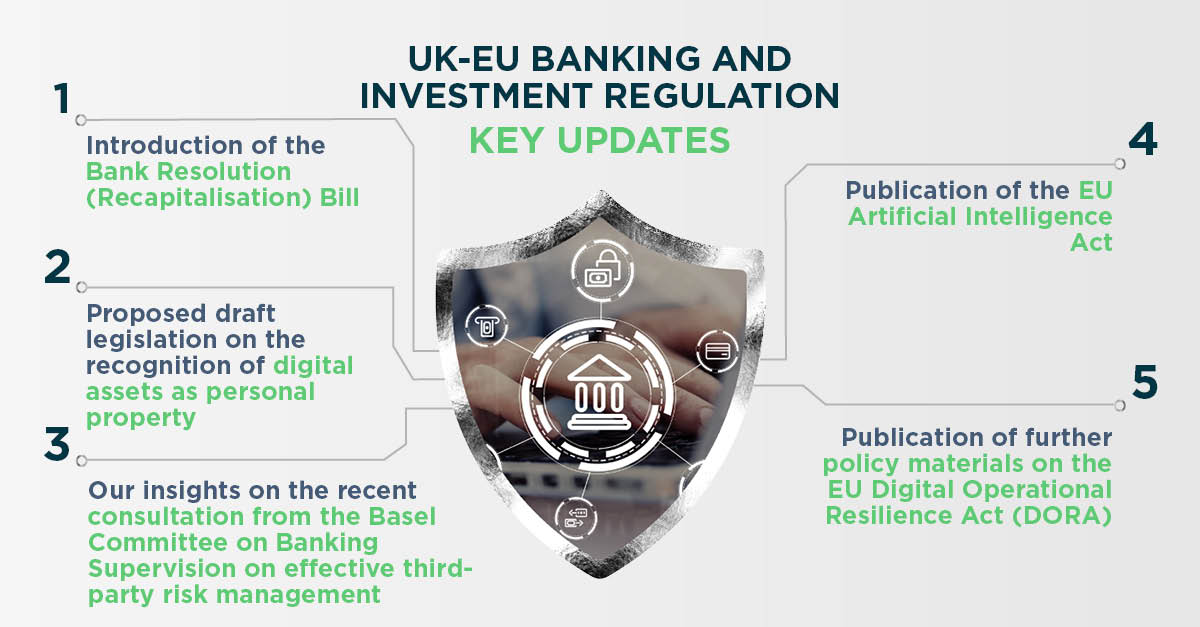

Bank Resolution (Recapitalisation) Bill

On 19 July 2024, the Bank Resolution (Recapitalisation) Bill 2024-25 was published on the UK Parliament website. The Bill, which was announced in the King's Speech, intends to introduce a new mechanism to allow the Bank of England to use funds provided by the banking sector to cover certain costs associated with resolution of failing small banking institutions under the special resolution regime (SRR).

Read here to know more on the changes brought by this Bill

Digital assets as personal property – draft legislation

On 30 July 2024, the Law Commission of England and Wales published a supplemental report and draft bill that, if implemented, would confirm the existence of a third category of personal property into which certain digital and other assets could fall.

Click here to read further on the Law Commission report and draft legislation

BCBS consultation on third party risk

The Basel Committee on Banking Supervision (BCBS) has issued a consultative document proposing a set of principles for the sound management of risks associated with third-party service providers in the banking sector. They address the increasing digitisation and rapid growth of financial technology, which has increased banks' reliance on third-party service providers.

For further details and possible implications please see our recent article here on this consultation

EU Artificial Intelligence Act published in the Official Journal

The EU Artificial Intelligence (AI) Act aims to provide AI developers and deployers with clear requirements and obligations regarding specific uses of AI. The aim of the new rules is to foster trustworthy AI in Europe and beyond, by ensuring that AI systems respect fundamental rights, safety, and ethical principles and by addressing risks of very powerful and impactful AI models.

Read here to know more on the EU AI Act

Final report on the ESA's second batch of policy materials under DORA

The three European Supervisory Authorities (EBA, EIOPA and ESMA – the ESAs) have published the second batch of policy products under the Digital Operational Resilience Act (DORA). This batch consists of four final draft regulatory technical standards (RTS), one set of Implementing Technical Standards (ITS) and 2 guidelines, all of which aim at enhancing the digital operational resilience of the EU’s financial sector.

Click here to read further on these technical standards

Upcoming events

For information on all our upcoming training events including our Regulatory Essentials programme, please visit our Financial Regulation page on our website.