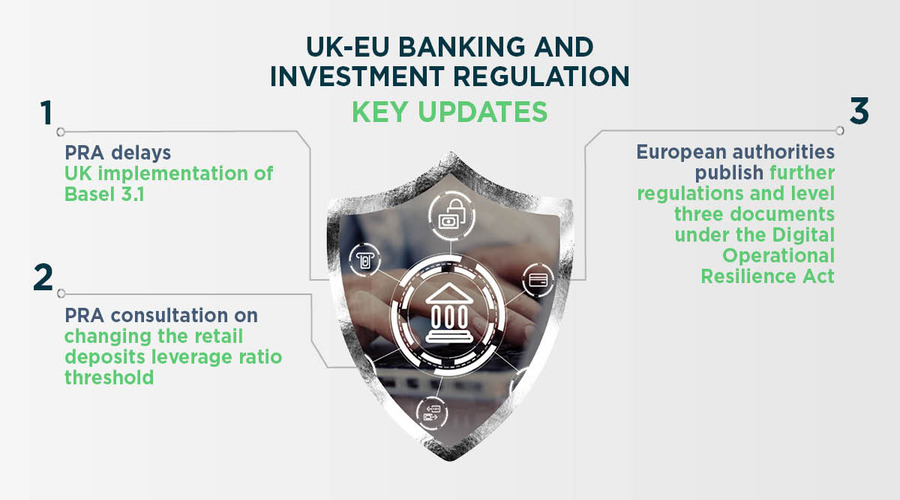

On 17 January 2025, the Prudential Regulation Authority (PRA) published a press release announcing that, in consultation with HM Treasury, it has decided to delay the UK implementation of the Basel 3.1 reforms to 1 January 2027.

On 17 January 2025, the Prudential Regulation Authority (PRA) published a press release announcing that, in consultation with HM Treasury, it has decided to delay the UK implementation of the Basel 3.1 reforms to 1 January 2027.

On 17 January 2025, the PRA published a press release announcing that, in consultation with HM Treasury, it has decided to delay the UK implementation of the Basel 3.1 reforms to 1 January 2027.

Given the current uncertainty around the timing of implementation of the Basel 3.1 standards in the US, and taking into account competitiveness and growth considerations, the PRA, having consulted with HM Treasury, has decided to further delay implementation of the rules.

In line with the approach taken for the six-month delay in PS9/24, the transitional periods in the rules will be reduced to ensure the date of full implementation remains at 1 January 2030, as set out in the original proposal.

In light of the delay to implementation, the end-date of the time-window to join the Interim Capital Regime – previously set as 28 February 2025 – will be moved back. The PRA is also immediately pausing until further notice the data collection exercise intended to inform an off-cycle review of firm-specific Pillar 2 capital requirements.

The PRA will continue to monitor developments and will provide further information in due course.

If you would like to discuss anything raised in this article, feel free to contact our Financial Regulation team.

Join our mailing list and receive the Top 3-5 UK-EU Banking and Investment Regulation updates you need to know about

SubscribeReceive UK-EU Banking and Investment Regulation updates to your inbox

Join our mailing list